FINALIZED IRS Regulations on inherited ira’s

Let’s breakdown the finalized regulations that were issued by the IRS on July 18th for people who inherited IRA’s in the year 2020 and later.

I’ve spoken about this twice over the years in episode 180 and episode 200. However, the IRS has finally cleared up a lot of questions that were left unanswered at those times.

If you inherited an IRA from a spouse, parent, sibling, or friend who died in 2020 or later you will want to read this!

You may remember me talking about the Secure tax act, it was passed in December of 2019 and brought major changes to the post-death tax treatments of qualified retirement accounts.

One of the biggest changes:

It eliminated the stretch treatment of post death distributions for non-spousal beneficiaries and replaced it with the 10 year rule.

What is the 10 year rule?

Prior to 2020, non spousal beneficiaries of qualified retirement account could chose to slowly draw down these retirement accounts by taking annual distributions from them based on their age.

New regulations ended this practice for anyone passing away in 2020 & later, stating that non designated beneficiaries must fully deplete the retirement account by the end of the 10th year following the owners death.

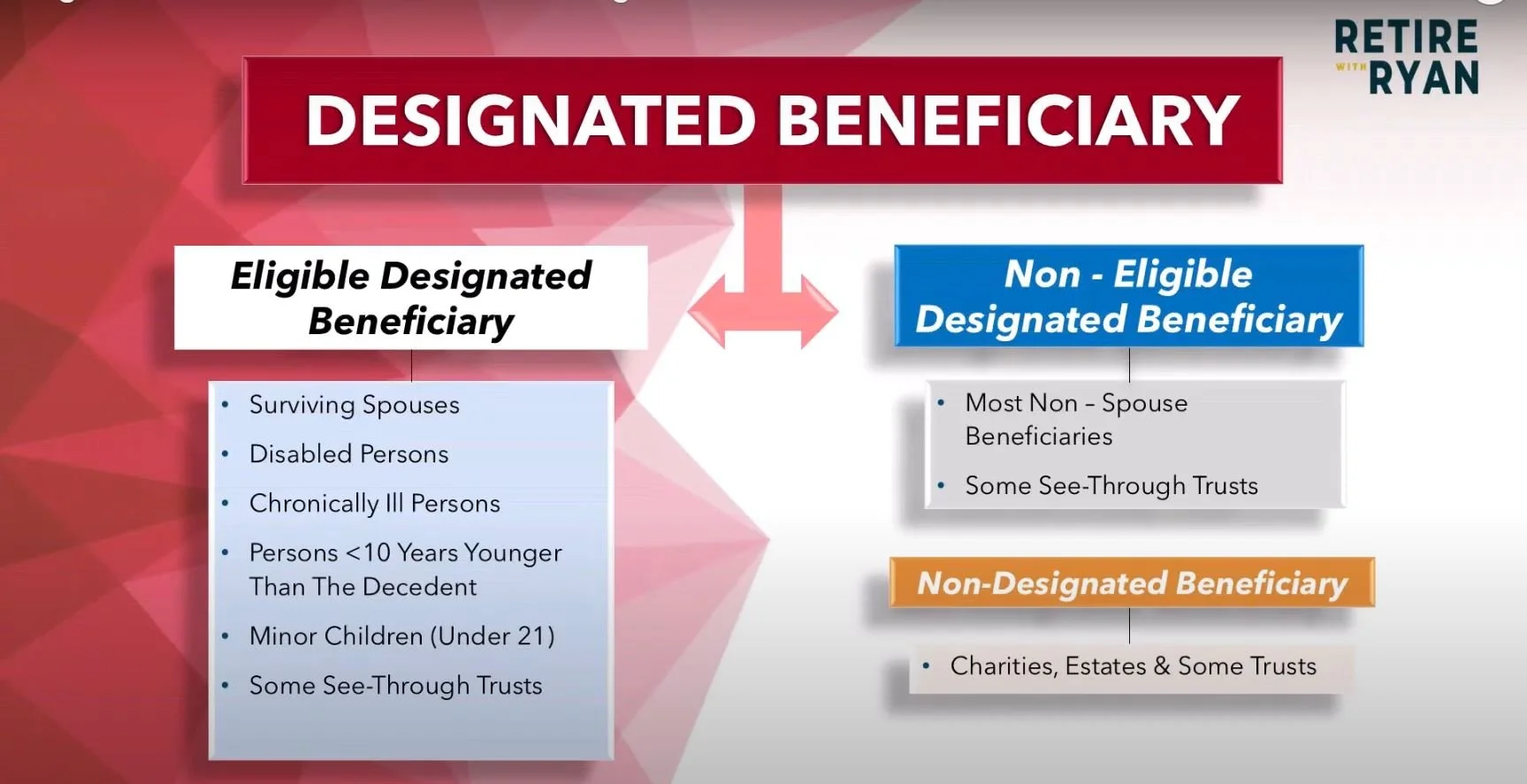

Who is considered an eligible designated beneficiary and who’s not?

Most people thought

The beneficiary could wait until the end of the 10th year to fully deplete the account. However, if they wanted to begin taking distributions sooner because it would create have a favorable tax treatment they could, but they were not required to do so.

Then the IRS released proposed regulations in 2022

These regulations made it seem as though that was not the case. This is what I talked about in episode 200. It seemed as though the beneficiary was actually required to take distributions each year during the 10 year window. They actually couldn’t wait until the last year to take distributions.

This got a lot of people worried that they should be taking distributions and because they hadn’t they would be subject to tax penalties.

In episode 215 I addressed the finalized regulations created by the IRS regarding inherited IRAs & their RMDs(required minimum distributions).

Which lead us to addressing two different types of beneficiaries who may be in this position and are affected by these new regulatory changes. Eligible and non eligible designated beneficiaries.

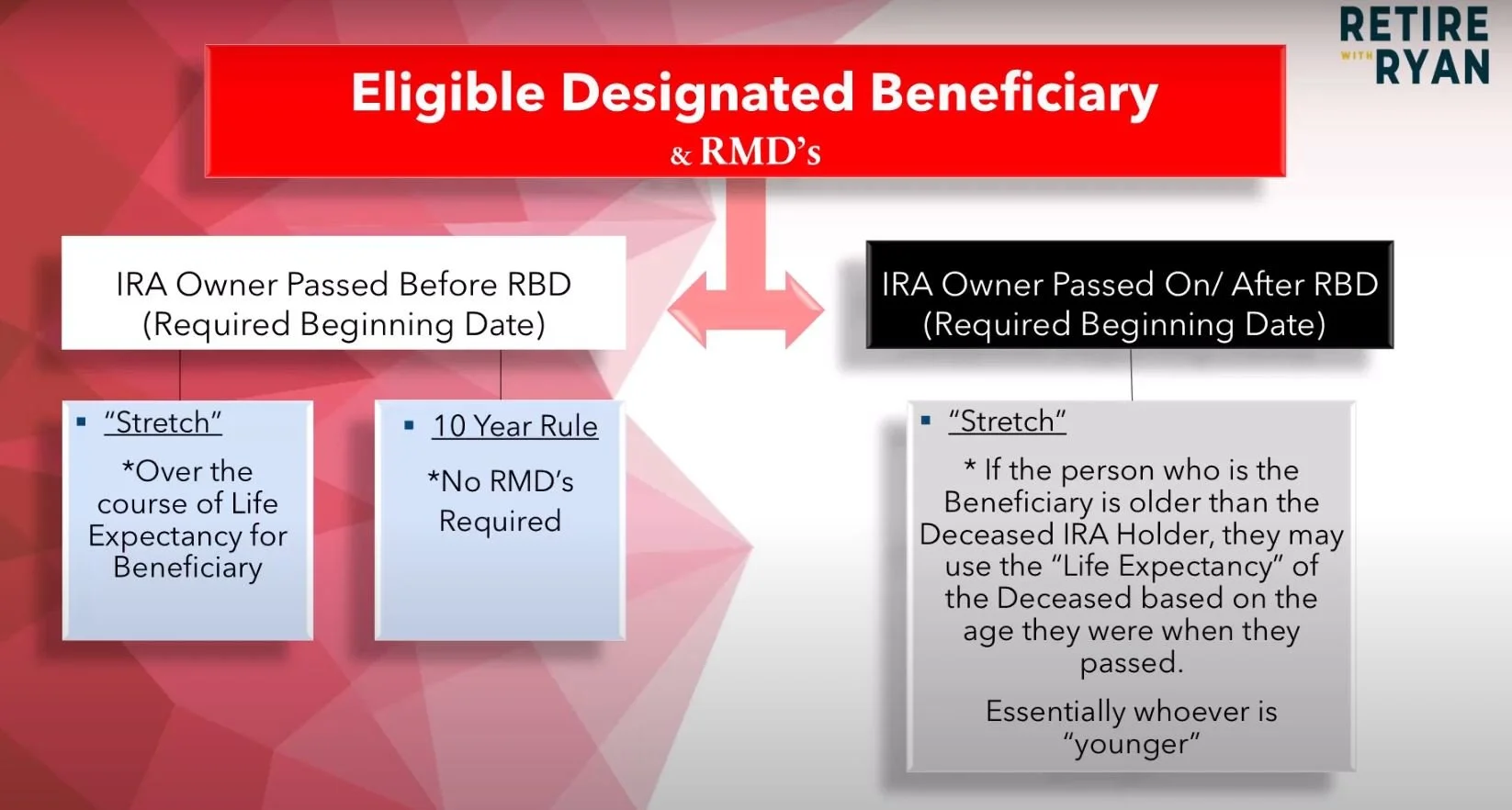

Please review this chart I’ve attached below to see the IRS’s position surrounding RMDs for Eligible designated beneficiaries:

The key component of the regulation for eligible beneficiaries was if the deceased owner of the now inherited IRA had passed before or after the required beginning date for them to take RMDs.

If the owner passed prior to being required to take RMDs eligible beneficiaries were given two options on how to handle to funds:

1) Utilize the formerly used “Stretch” rule in such the distributions may be made over the course of the life expectancy of the beneficiary.

2) The 10 year rule would be in effect, in which there are no RMDs through this 10 year period. However, at the completion of the 10th year the funds must be completely withdrawn from the inherited IRA.

What if the deceased owner of the IRA had reached the age RMDs began and were mandatory?

In this scenario the designated beneficiary is required to take RMDs pursuant the “stretch” method. However the beneficiary may elect, if they are older than the deceased owner was at their time of passing, to use the life expectancy of the deceased instead of their own. Essentially they were given the option to us the life expectancy of whomever would be younger.

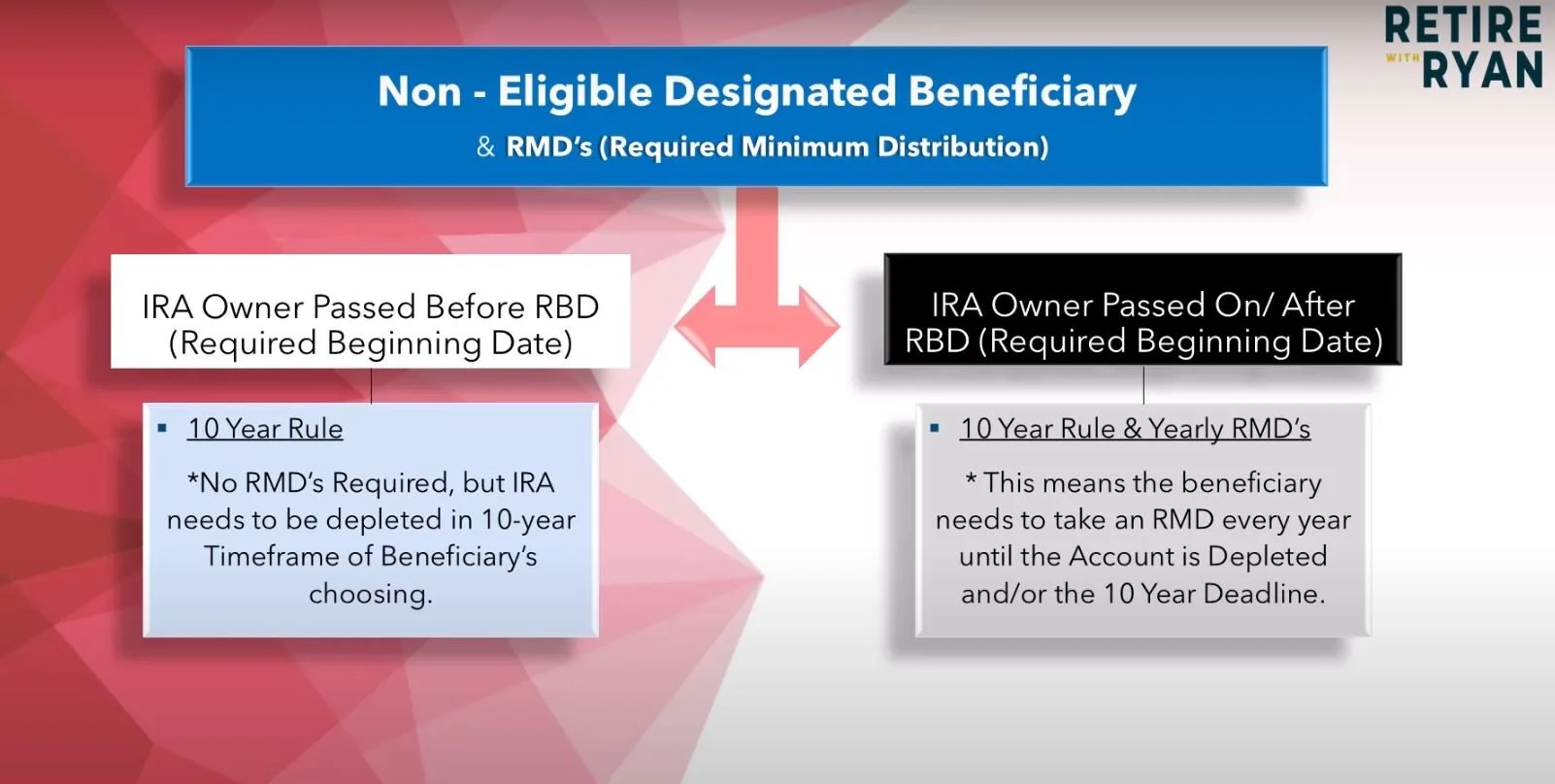

What about non-eligible designated beneficiaries?

please review the chart below and I will further explain what I am showing you right after.

Much like for eligible beneficiaries the key component of the regulation was if the deceased owner of the now inherited IRA had passed before or after the required beginning date for them to take RMDs. But with different outcomes then we saw for eligible designated beneficiaries.

In both scenarios the 10 year rule is the only options, however this afore mentioned component has an affect on whether RMDs are required or not.

1) If the deceased owner of an inherited IRA by a non-eligible designated beneficiary passed before RMDs were required then the beneficiary would have a 10 year timeframe of the beneficiaries choosing, with no required minimum distributions. Essentially meaning they can initiate the 10 year window, and wait until the 10th year to deplete the account, likely in the event that doing so would result in a more favorable tax treatment/consequence.

2) If the deceased owner of an inherited IRA by a non-eligible designated beneficiary passed after RMDs were required then the beneficiary must begin take RMD’s immediately, and all funds must be withdrawn from the acount by the 10 year deadline.

I know there is a lot that I covered in this episode & article, but it’s extremely important that you come up with a distribution plan for any inherited qualified retirement accounts you may have. You don’t want to have to pay more taxes than you should, or even worse pay a tax penalty for missing RMDs.

If you’re not working with a fee only financial advisor, now could be a great time to reach out to one. As an honorable mention, thank you to those who have purchased a copy of my book called “Fiduciary”, a comprehensive guide on how to find, hire, and establish an reliable and trusted relationship with a fee on financial advisor, and what pitfalls to look out for in your selection process. If you’re in the market for a financial advisor or you’re wondering if your current advisor truly has your best interest at heart, then you should check out my book. You can get yourself a FREE digital copy by clicking the golden banner at the top of this webpage. Or if you more prefer a hardcopy you can click below to order it on Amazon marketplace.

As well, If you have a question or topic that you’d like to have considered for a future episode you can leave it by going to www.retirewithryan.com and clicking on ask a question.

As always, have a great day, a better week, and I look forward to talking with you on the next blog post, podcast, youtube video, or wherever we have the pleasure of connecting!

Written by

Ryan Morrissey

CFP® , CLU® , ChFC® , CMFC®

Father, husband, author, Golf lover.