5 Ways to Hedge Your Retirement Income Against Inflation

Inflation has gone down, but remains elevated and is likely to persist for an extended period. The impact of high inflation is far-reaching and can have long-term effects, such as reducing the real value of your portfolio due to the decline in the value of the dollar. Inflation can also erode the purchasing power of your retirement income, making it necessary to protect it against inflation. That's why I am here to share with you five effective ways to hedge your retirement income against inflation, so you can mitigate the impact of inflation until the Fed brings it under control.

Key Takeaways:

· Delay collecting your Social Security benefit at least until full retirement age

· Does your pension have a cost of living adjustment

· Invest in stocks and real estate

· Why you need I-Bonds in your retirement portfolio

· Is your portfolio worth its weight in gold?

Delay Collecting Your Social Security Benefit At Least Until Full Retirement Age

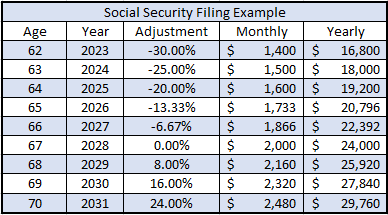

If you are up to date on my podcast episodes, then you have heard me talk about Social Security and delaying your benefit several times. I typically recommend that most people wait at least until their full retirement age to begin collecting benefits. You can collect as early as age 62, but you would receive a reduced benefit. Other than the reduced amount, the cost of living adjustment (COLA) that applies to your benefit would be smaller as well since it would apply to your reduced benefit.

For example, imagine a scenario where your early benefit would pay $1,000 a month and your full retirement benefit would pay $2,000 a month. You also get a 5% cost of living adjustment that is applied on a dollar basis. The $1,000 a month COLA would be $50, while the $2,000 a month COLA would be $100. Therefore, delaying your benefit does not only provide a larger benefit, but also a larger adjustment to help your portfolio keep pace with inflation. Anyone can do this; all you need to do is not collect until you reach full retirement age which falls between ages 66 and 67 depending on what year you were born.

An individual’s Social Security benefit continues to grow once they’ve passed full retirement age. Anyone born after 1960 will receive an 8% increase in their benefit for every year passed their full retirement age up to age 70. Those who wait until age 70 to collect their benefit will receive a 24% higher amount for waiting the extra three years. To contrast, anyone who takes their benefit before full retirement age receives a reduced benefit.

A great place to learn more about the cost of living adjustment would be the Social Security website. Not only does it describe COLA, but it also provides a list of all the cost of living adjustments since 1975. In 1975, the COLA was 8% and the highest adjustment so far was 14.3%. The adjustments have been low in recent years, but the 2022 COLA was 5.9% due to the high inflation that we have been experiencing. The Social Security Administration points out that since 1975, the COLA’s were mandated, unlike in the past where the COLA was determined by the Consumer Price Index (CPI). Since 1975, COLA has averaged 3.68%, while I have seen data going further back than 1975 where the average COLA was 2.6% which shows these adjustments are higher now than they used to be.

The negative with delaying your Social Security benefit is that you must live long enough to make back what you gave up when you decided to delay your benefit. A common strategy is to calculate the breakeven point if you delay your benefits to determine what age you need to live to for delaying your benefit to be worth it. I will cover an example where I can illustrate the process below.

Imagine you are deciding to collect your benefit between ages 62 and 67 (full retirement age). You could receive either $2,000 from Social Security at age 67 or a reduced benefit of 70% ($1,400) if you claim your benefit at 62. To calculate the breakeven, you would multiply $1,400 by the difference in months (5 years x 12 months = 60 months). Therefore, $1,400 x 60 = $84,000. You would then divide the $84,000 by the difference in benefits which would be $600 a month ($2,000 - $1,400 = $600). This would result in 140 months which equates to 11.67 years. The way you could interpret this is that if you live to at least age 73.67 then delaying your benefit would be worth it.

Granted, our model did not include the increases in COLA which would reduce the number of years it would take to breakeven. If you wanted to create an exact financial model, then you could use excel or financial planning software to calculate the specific figures rather than an estimate. Generally, the breakeven age for deciding whether to take your benefit early will be around 74 years old. This calls for an analysis of your health and direct-family member’s health to determine if waiting is the right decision for you. If your family shows longevity where most members of your family live to late 80’s, then it would make sense to delay your benefit. To contrast, if you have a poor heart or some type of condition that troubles you then it may be wise to collect your benefit early.

Does Your Pension Have a Cost of Living Adjustment?

The second way to hedge yourself against inflation in retirement is through a pension with a cost of living adjustment. You need to investigate how that pension works and how that cost of living adjustment is calculated. Any pension that offers a COLA will give you information as to what they tie the cost of living adjustment to whether that is the Consumer Price Index (CPI) or a similar index. You need to also investigate whether there is a cap on the index to decide whether the COLA option is suitable for you.

Similar to waiting to collect your Social Security until full retirement or age 70, pensions reward those that delay their benefit as well. Remember, if you choose the pension option with a COLA, then your benefit will be lower than the generic payout method with no riders. Therefore, you need to determine what breakeven is. From there you could decide which option makes more sense for you based on your health, liquidity needs, and time horizon. For example, if it takes 20 years for the pension with the COLA to catch up to the payout of the non-COLA pension then it wouldn’t make sense to take the COLA option. This would likely be too long for the pension with a COLA adjustment to catchup so it would make more to take the non-COLA option and collect the higher benefit for however long you live.

Invest in Stocks and Real Estate

The third way to hedge your retirement income against inflation is to have a significant allocation of your investments in stocks or stock funds. If we look at the S&P 500, since 1957 the index has had an average annualized return of 10.5% through 2021. If we instead look back at the past 30 years, then you can see that the index has averages 10.72% which was about 8.29% once adjusted for inflation. Therefore, if you want to keep pace with inflation then stocks are one of the best investment vehicles.

Investing in the stock market can be a great way to build wealth and achieve financial goals, but it's important to understand the risks involved. While the S&P 500 has historically provided strong returns over the long term, it also experienced significant declines over shorter periods of time. In fact, over the last 30 years, the index has had an average inter-year decline of 15.7%, with six declines of over 30%. The most recent drawdown occurred in March of 2020, during the Covid-19 pandemic. As with any investment, it's crucial to remember that there is no such thing as a free lunch. While the potential for high returns may be attractive, investors must also be prepared for the possibility of significant losses. Understanding the risks involved in investing in the stock market can help investors make informed decisions and manage their portfolios accordingly.

The best advice is to have a diversified portfolio to protect yourself during inflationary periods. Investing in stocks is crucial because when you purchase a stock you are technically purchasing a portion of the company. These companies can keep pace with inflation because they can raise the prices of their goods/services during such times. Although not all products are worth the additional funds to their consumers which can lead to restricted cash flow and potential bankruptcy. That is why having a diversified portfolio with a variety of stocks that span across multiple industries can improve the performance of your investments while experiencing high inflation. Most of the companies you invest in will be okay so the downside of the companies that cannot survive will be limited.

Real estate is another good investment during inflationary periods. This includes physical real estate, real estate funds, and real estate investment trusts (REITs). REIT’s have not performed well the past couple of years so I would suggest real estate funds or physical real estate. The advantage to real estate is that landlords can raise the rent when inflation is high because their taxes and maintenance costs would have increased. Therefore, the higher rent (earnings) mitigates the effect of high inflation, but the same drawback occurs. If you raise the rent too high, it could cause tenants to leave and leave vacancies in your property. So, you need to be prepared for volatility in your real estate as well.

Why You Need I-Bonds in Your Retirement Portfolio

Owning I-bonds is another great way to hedge yourself against inflation. I-bonds are different from your typical government/corporate bond because their interest rate is determined every six months based on the Consumer Price Index (CPI). In high inflationary periods, the CPI significantly increases which in turn increases the rate I-bonds pay. The last I-bond cycle which you could have purchased by May 1, 2022, is paying an annualized interest rate of 7.2%. Which means that you would receive a 3.6% return until the rate is recalculated based on how much CPI changed over the six month period. If CPI went up then the rate would increase, but if CPI went down steeply then the interest rate would be reduced. Regardless, the I-bond is a great hedge during inflationary periods and will provide a better return than what you’d receive for holding the money in the bank. Although, during period of low inflation, stocks and real estate will likely provide better returns than the I-bonds.

I-bonds are conservative investments, they are not meant for large growth. Additionally, there are limits on the number of I-bonds you can purchase. Each married couple can buy $10,000 worth of I-bonds per Social Security number. As their guardian, you can purchase up to $10,000 worth of I-bonds for each of your children that are minors. Lastly, you could invest up to $5,000 of your tax refund into I-bonds bringing the maximum investment up to $15,000 per individual. However, if you do not receive a tax refund, or owe the government taxes, then you would be limited to $10,000. Therefore, the apparent disadvantage to I-bonds are restrictions on the amount you can purchase.

Is Your Portfolio Worth its Weight in Gold?

The last hedge against inflation that I will cover is commodities, as certain commodities have been historically good hedges against inflation. The two that likely come to mind are gold and silver. Gold tends to have an inverse relationship to stocks during market declines so while stocks are sinking, the price of gold will rise. This isn’t always the case, but there are several examples of where it was.

That said, gold is not only a good investment during periods of high inflation. From 1990 to 2020 the price of gold rose 360%, while the Dow Jones Industrial Average (DJIA) rose by 991%. Investing in the stock index or real estate would have resulted in a significantly larger return during that time. However, if we look at the most recent 15 years, from 2005 to 2020, the price of gold increased by 330% while the DJIA only increased by 153%. Therefore, performance relative to the stock market will vary, but both will experience similar volatility.

There are a few different ways that you can invest in gold. The first method is to own physical gold which is common. The negative to this method is that you must store the gold somewhere. This would have to be somewhere it could not be stolen easily such as a safe or safety deposit box. The other negative is that you will have to pay a spread when you buy or sell the gold. Let’s say you have an ounce of gold which sells for $1,000. You cannot turn that $1,000 worth of gold into $1,000 cash because the gold dealer will charge you 3-5% to facilitate each transaction making it more like $950.

Another way to invest in gold is to purchase a mutual fund or exchanged traded fund. There are a number of these funds that invest in physical gold and hold it in vaults across the world. The shares they issue are backed by physical gold and the two most popular funds would be SPDR Gold Trust (GLD) and iShares Gold Trust (IAU). These were the original two gold funds created about 20 years ago. However, there is competition with lower ongoing expense ratios such as SPDR Gold MiniShares Trust (GLDM). Therefore, if you wanted gold exposure in your retirement or investment account, then buying something like GLDM would be a great way to do that. The spread you would pay on your transactions would be less than 1% which is better than the 3-5% you would have to pay with physical gold.

You could buy other commodities too like a silver fund or even a diversified commodities fund. The diversified fund will not limit their investments to precious metals, they will invest in various commodities such as soybeans, grain, and energy. This sounds like a positive, but the funds such as the Invesco DB Commodity Tracking Fund, DBC have had very low returns over time. The fund came out in early 2016 and has only increased by 15% since then, while the S&P 500 Index has increased 230%. Therefore, diversification is great, but not necessarily when it comes to commodities.

To conclude, these are five great methods to hedge against inflation. With inflation this high, the first thing I would recommend is to purchase the I-bonds. The rate of inflation they provide will not be this high forever so you should take advantage. Next, the stock market is down significantly from it’s all time high which means shifting your allocation to more equities could be a good idea. This way you can lock in any tax losses on your taxable accounts and increase your gains when the market rebounds. For any excess cash, if you want to further hedge your portfolio then my last recommendation would be to purchase one of the gold funds I mentioned above. Other than that, you can handle delaying Social Security and choosing a pension option with a cost of living adjustment when they come up.