The Deferred Resignation Offer Deadline 2/6/2025

Here are 3 important things to consider before you decide!

If you're a federal employee and you're considering accepting the deferred resignation offer that’s been presented by President Trump, you'll definitely want to read this blog.

A BIT ABOUT ME

My name is Ryan, and I’m a financial planner working with clients who are over the age of 55. Most of my work is geared towards helping my clients prepare and plan for a successful retirement. The goal of this blog is to help you make the best choice for your situation.

Over the last few days, I’ve been getting several questions about the recent offer by the federal government and how it relates to someone’s retirement plans.

#1: CASH FLOW NEEDS

The first thing we should talk about is your cash flow needs in retirement. At its core, retirement planning is all about cash flow replacement. While you’re working, you receive a paycheck, and if you're a federal employee, you're paid every two weeks, with money directly deposited into your bank account to cover your expenses.

The question for anyone retiring, federal employees included, is: Will the money you receive in retirement be enough to replace your paycheck so that you can retire?

When it comes to calculating your cash flow needs. One option is to look at your take-home pay every couple of weeks and see if you’re spending all of it or just a portion of it. No budget or anything, more just eyeballing your spending. This can be helpful and it isn’t too time-restrictive. However, there are better ways to do this.

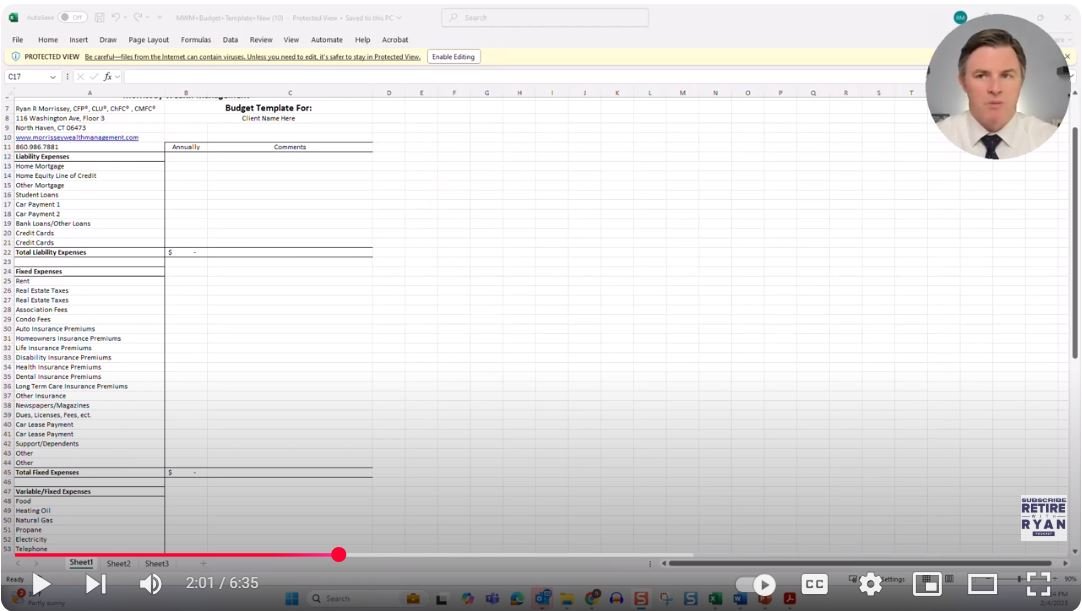

If you want a more in-depth option, you can put together a budget. I have a link below where you can download a budgeting template. In my opinion, it’s essential to create a budget anytime you're planning for your retirement. This will help you get an accurate idea of what your expenses will look like.

Click here to check out my free budget template!

At the end of the day, the more information you have when planning your retirement, the more prepared you’ll be. Resulting in a clear picture of your expenses, helping you avoid any surprises later on.

Now, back to the main point: If you’re a federal employee considering this deferred resignation offer, one of the most appealing aspects is that you will continue to receive pay until the end of September.

WHAT ARE THE PERKS?

For some, this could mean not having to show up to work for several months. Additionally, it could also mean not having to go into the office, especially if you’ve been working remotely.

However, when that ends in September, the key question is: Will your cash flow be enough to keep you comfortable without the need to return to work?

If you plan to find another job to bridge the gap to retirement, that might be possible. But if you're unsure whether you can retire right now, there are a few things you need to think about.

#2: HEALTH INSURANCE COSTS

The next thing to think about is whether or not you’ll be eligible for health insurance. This is a significant part of many people’s budgets.

If you’ve worked for the federal government for at least five years and have been enrolled in the Federal Employees Health Benefits (FEHB) system during that time, and you’re eligible for a pension immediately upon retirement, you can continue your health insurance coverage at a subsidized rate.

This means you won’t have to pay the full cost of health insurance in retirement, which could be a major saving.

However, if you haven’t been in the FEHB system for at least five years and you're relying on your spouse’s plan or recently switched to the system, you won’t be able to continue your health insurance under the same terms. In that case, you would either have to pay the full cost (with a 2% premium increase) or seek health insurance through your state’s marketplace. The latter may offer a subsidized plan, but this will depend on your situation.

If you’ve been paying $300-$400 a month for health insurance and suddenly find yourself needing to pay $2,000 a month, this could be a huge shock to your budget and cash flow. In that case, retiring might not be feasible, and you may need to rethink your options.

#3: UNDERSTANDING YOUR PENSION

The last step is to think about your pension. As a retired federal employee, your pension could significantly impact your retirement planning.

If you’re under the Federal Employees Retirement System (FERS), the amount you’re eligible to receive depends on your age and years of service. Understanding how your pension works is crucial.

If you accept the deferred resignation offer, you need to know if it will significantly reduce your pension. If it does, you may decide not to accept the offer. Or, if you accept a reduced pension, you may find another job that supplements your income, helping you make up the difference.

In conclusion, it’s impossible to provide a one-size-fits-all answer about whether this deferred resignation offer is right for you. It really depends on your individual circumstances.

But here are the key things you should consider:

What will your cash flow look like if you accept the offer and are unable to find other employment? Will you be okay?

What are your health insurance options, and how will they impact your budget?

Are you eligible for a pension, and how will that impact your retirement?

How will your pension change if you accept this offer? Could working a few more years actually increase your pension benefit?

These are important questions to consider, especially with the February 6 deadline approaching(which is tomorrow at the time of typing this blog post). If you need assistance, feel free to reach out to us at Morrissey Wealth Management, and best of luck with your decision!

If you have a question or topic that you’d like to have considered for a future episode/blog post, you can request it by going to www.retirewithryan.com and clicking on ask a question.

As always, have a great day, a better week, and I look forward to talking with you on the next blog post, podcast, YouTube video, or wherever we have the pleasure of connecting!

Written by Ryan Morrissey

Founder & CEO of Morrissey Wealth Management

Host of the Retire with Ryan Podcast